Many people dream about becoming a millionaire. Winning the lottery, discovering a distant rich family member, or marrying into royalty – how it happens doesn’t really matter. But in reality, most of us have no idea how to become a millionaire.

Well I am going to show you how to become a millionaire the real, proven way.

But before we move on, I am going to come out straight away and say it:

Becoming a millionaire is SIMPLE,

but not easy.

But before you close this page and move on with your day hear me out!

Because when it really comes down to it, with a steady income and a good amount of financial discipline, becoming a millionaire within your lifetime is 100% possible.

And all it comes down to 2 simple numbers which I refer to as:

The 25-25 Method

How it breaks down is simple and straight forward.

If you invest $25 everyday for 25 years

you will have a portfolio worth $1,000.000.

– Yes, it is really that simple –

Before you tell your self that this is impossible, I want to emphasize that although this process is straight forward and easy to understand, it is not meant easy.

If becoming a millionaire was easy, then everyone and their uncle would be one!

But the important thing is to invest something, and realize that

by doing nothing, you are missing out on a more safe and secure financial future!

What I mean is that your investment plan doesn’t need to be 25-25! You can make any modification of this to fit your needs.

$10 for 30 Years.

$5 for 50 Years.

The most important thing is that you start by…

Making Changes to Your Financial Habits

Financial success doesn’t happen by waiting for some magical change to fall upon your future, you need to make that change happen yourself!

If you have the same spending and investment habits (or lack there of) of everyone else around you, then you will never end up any further ahead than anybody else.

If you really want to be a millionaire you need to push out those unrealistic fantasies you held in the past of getting rich quick and start your path to become a millionaire the long, challenging, but exciting way.

So, with an open mind and a bit of courage, let’s get into the math and magic of how all of this really works.

How to Become a Millionaire: Breaking Down the Math

To really get into how the 25-25 plan works, let’s look at some simple math of investing.

To reinstate, this plan assumes that you put $25 a day, everyday, into the stock market for 25 years.

In this investment plan, we use the S&P 500 stock index.

Why?

Because over the past 90 years, even through world wars and political crisis, the S&P 500 has had an average annual return of 9.8 percent.

This rate of return also assumes that you re-invest any dividends you receive from your portfolio each year. This form of investing could be in the form of stocks or ETFs.

I know there will be critics saying this high number is unrealistic, and overly optimistic.

– Before you start getting angry in the comments section, I want to emphasize that –

This is Simply a Thought Experiment To Show the Power of Long-term Investment!

Yes, some years the index does better, some years are worse, and your path to a million may time more time or more money than in this scenario.

But remember – the goal of this article is to not predict the future of the market, but to educate people on the power of long-term planning.

Calculating your Daily Return on Investment (ROI)

Now, the following math might be a little confusing if you aren’t familiar with investing. That’s OK!

(You don’t need to understand the formulas and details 100%, and if you aren’t a numbers person you can skip this overly math-y section and move onto the next section.)

I have also created an easy to use Excel Sheet where you can change your daily investment amount and find out how quickly your money can grow.

You can download the Excel Sheet here:

Download: How to Become a Millionaire Investment Plan.xlsx

To figure out how much our money will grow, we must first start by finding our daily return on investment (ROI).

Keep in mind that because we are adding money to our investments each day, we need to calculate a compounded, daily ROI for our money already invested in the markets vs. the money we are adding in each day to get an accurate yearly return.

To calculate our daily ROI value, we simply divide 9.8% by 365.

This gives us a daily return of 0.0268493%.

Next we need to formalize our daily ROI as we add more money each day.

To do this, we simply multiply our previous day’s total by our daily ROI percent, then add $25 for the following day to amount to our total value.

This then allows us to see how our money which is already invested is growing while we are adding more money in each day.

Our formula should therefore look like this:

(Previous Day Portfolio Value x 1.000268493) + $25 = Current Daily Portfolio Value

Example:

Our Day One money invested is $25. Our Previous Day Portfolio Value is 0.

Therefore our formular for the first day look’s like this:

($0 x 1.000268493) + $25 = $25

So our total end of Day 1 value is simply $25.

For Day Two, we take our total portfolio value from our previous day ($25),

multiplied by our daily return (0.0268493%),

plus our new investment ($25).

This gives us our Day Two total value:

($25 x 1.000268493) + $25 = $50.0067~.

We continue this calculation with the same formula for each consecutive day of the year:

So, our Day 3 value would look like this:

($50.0067~ x 1.000268493) + $25 = $75.0202.

Our returns seem very small at first but,

you have to keep in mind the effect of compounded returns.

This means that our growth from our previous days will begin to multiply upon itself (compounding) and our money will start to work for itself!

Here is a breakdown of our money invested vs. money returned vs. our total portfolio value of the first year, on day 365.

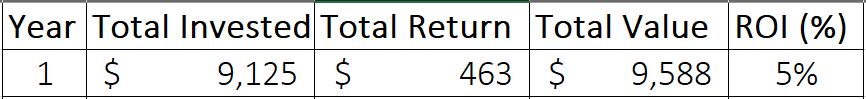

Portfolio Returns After One Year

The effects seem slow at first, but grow quickly the longer we leave our money in the market.

( And this is the key, to put your money into the stock market and NOT TOUCH IT)

You can see that over the course of one year (365 days) we invested a total of $9,125.

With our daily compounded return, our total money gained was $463.

This plus our original money invested ($9,125 + $462) gives us our final portfolio value of $9,588.

You may be thinking that $463 is not a lot of money, compared to the money we put in – and you are right.

But thins are going to speed up quickly!

Let’s see just how our Rate of Return changes year to year.

Calculate Your Yearly Return

To calculate our ROI we take our Total Money Gained divided by our Total Money Invested.

This leaves us with a 5.07% return overall for year one.

This percent seems low at first because we are adding money daily, so the total value of our money in doesn’t start gaining interest until after we invested it.

Therefore, our first year is only about half of the approximately 10% return we were aiming for.

But Wait!

Remember that we are investing for the long run!

And the magic of investing starts to really happen the longer you leave your money in, and

allow the effects of compounded interest to really get to work!

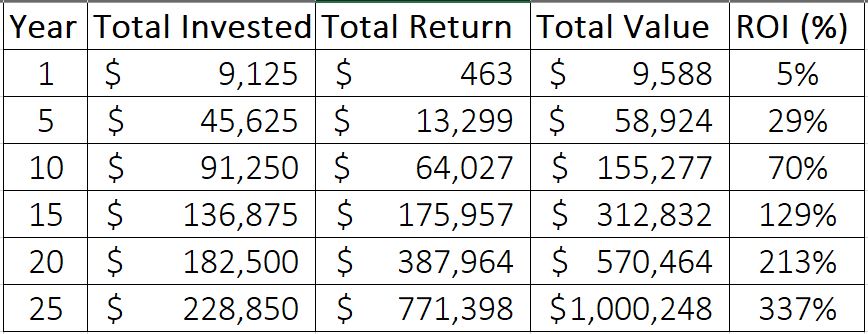

When you look at your difference on ROI the span of 5 year increments, then you can really start to see the power your money at work!

From year 1 to year 5, our ROI jumped from 5% to 29%, a near six fold increase.

And you think that is impressive until you realize that,

The Growth Only Gets Faster!

Investment Over 25 Years

By Year 15, our ROI is beyond 100%, meaning that we have more than doubled our original money in.

By year 20, we have more than tripled our money in.

By year 25, we hit our magic $1 million dollars, with a portfolio value over four times the value of our money invested!

With a mere $228,850 invested, we managed to build a portfolio worth over $1 million.

Compare that to putting it under a mattress, or worse – spending it!

Yes, it is really that simple. After 25 years (and 29 days) of $25 a day, everyday,

You are a Millionaire!

Even better, now that your money is invested and working for itself, will only grow faster each year,

you can live off your portfolio gains without ever touching the principle, and never work a day in your life again!

I am going to write more about how to retire early in a future article,

but this $1 Million dollar portfolio is really the magic number to be financially independent for the rest of your life!

Some Things to Keep in Mind

Now, it is important to realize that this math is not perfect, and

it does not take into account a lot of different variables.

– For Example –

Inflation

This is the idea that the value of your money will weaken over time. With this in mind, the burden of your investment will only get easier.

This is because the effective value of $25 will become less and less each year as wages increase, and goods become more expensive.

You can easily offset inflation and actually achieve your investment goals sooner than 25 years with a simple tactic.

Simply increase your daily investment by 50 cents every year, that being, by year 2 invest $25.50 daily, year 3 $26, and so on.

This steady increase could take years off of your path to $1 million!

Another thing to keep in mind is that,

No One Can Predict The Market

This is because markets do not move at a regular rate, and our 9.8% return on investment is only a rough estimation. Markets do better some years, worse some years and rates may not be this high in the long run!

A lot of this may sounds scary and a bit nerve racking, and most of all, difficult, but really step back and remember that,

You – Yes – YOU

Can Do This Too!

Before you dismiss this investment plan and move on to another corner of the internet, take a moment to really think about the real possibility of applying this strategy to your own life.

– What kind of changes would you need to make, and feasibly how you could fit this into your life? –

It is easy to be pessimistic about your financial situation, but really step back and look at things in a positive way.

If you have a full-time income, then you likely CAN do this in some shape or form.

In the United States, the median household income being $59,039.

Assuming you and your partner are two full-time wage earners, taking this challenge on together, that means setting aside a portion of your income each month for investment!

Not chump change, but with the proper discipline and will power – a real possibility.

Leverage That 401K

Not to mention, if your employer offers 401k matching or a similar investment fund,

you could cut your daily out-of-pocket investments by half.

What I am trying to say is, don’t tell yourself that this plan is “for someone else”.

Really sit back, plan, and find a way to fit long-term investing into your life.

Finding a Plan That Fits your Best

Perhaps there truly, in all honesty is no possible way you could manage $25 a day. That’s fine!

Investing even a little on a regular basis can go a long way!

Even $10 a day, for example ($300 a month, or $5 each between 2 people).

After 25 years would leave you a portfolio of $396,696, almost half a million bucks!

What I really want to emphasize is that if you are a median family in the developed world, and if you make an active decision to sacrifice a little each and every day for the long-term, and truly follow through in the long term, then:

Becoming a Millionaire is 100% Achievable in your lifetime!

Investment and financial security takes work, patience, and planning.

What is important is that you start early, be consistent, and stay in it for the long-run then,

You too can become a Millionaire.

Test it our Yourself

If you haven’t already, you can also download a handy Excel Sheet I made up to test your daily investment amount and see how long it will take you to reach $1 million dollars.

You can download the Excel Sheet here:

Download: How to Become a Millionaire Investment Plan.xlsx

If you don’t know already, I have started my own investment journey to one day reach $1 million dollars.

I call it the “Share aDay Challenge”, in which I buy one share each day of the year from a different company on the S&P 500.

Stay in the Loop!

Share aDay is all about living better and working smarter. If you are interested in working online, traveling, and financial independence, then subscribe to the site!

You can also follow my investment journey on Facebook and Twitter, and subscribe to Share aDay above for notifications of new tips, tricks and updates along my investment journey.